One of the most controversial pieces of President Biden’s Inflation Reduction Act (IRA) was its commitment to spend $80 billion to strengthen the IRS, including the hiring of 87,000 additional employees over the next decade.

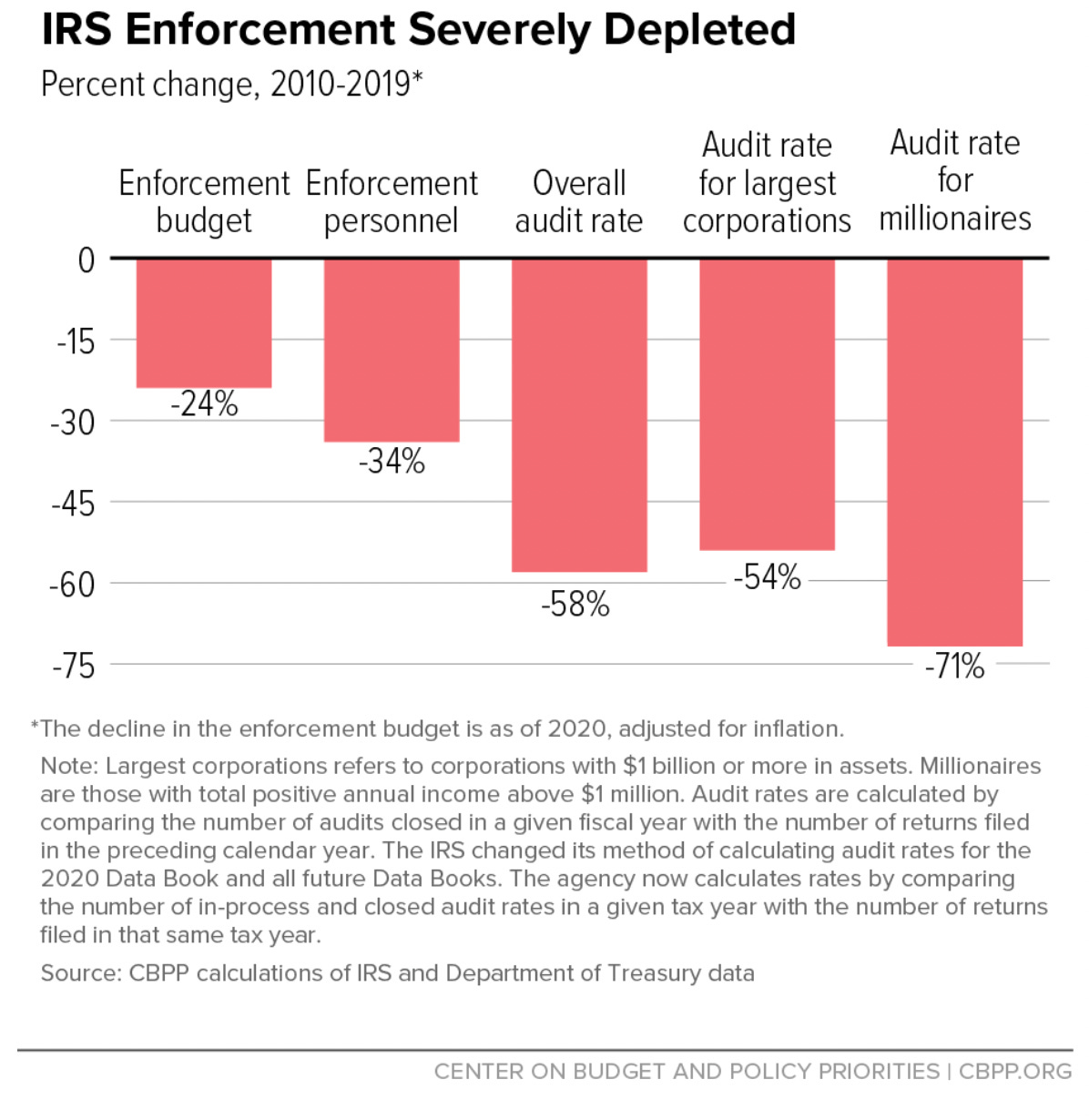

This marked a major reversal of IRS divestment. The IRS enforcement budget declined 24 percent in the 2010s with the number of enforcement personnel declining 34 percent. With the IRS workforce aging, the agency struggled with recruitment. The agency still relies on the obsolete COBOL programming language (out-of-date for nearly 40 years), and leaves employees with limited opportunities for career advancement and building skills— not to mention the job insecurity produced by an ever-declining enforcement budget. While the IRS plans to hire 7,200 new enforcers over the next two years, 4,700 of these will merely be replacing workers expected to retire.

Source: Center on Budget and Policy Priorities

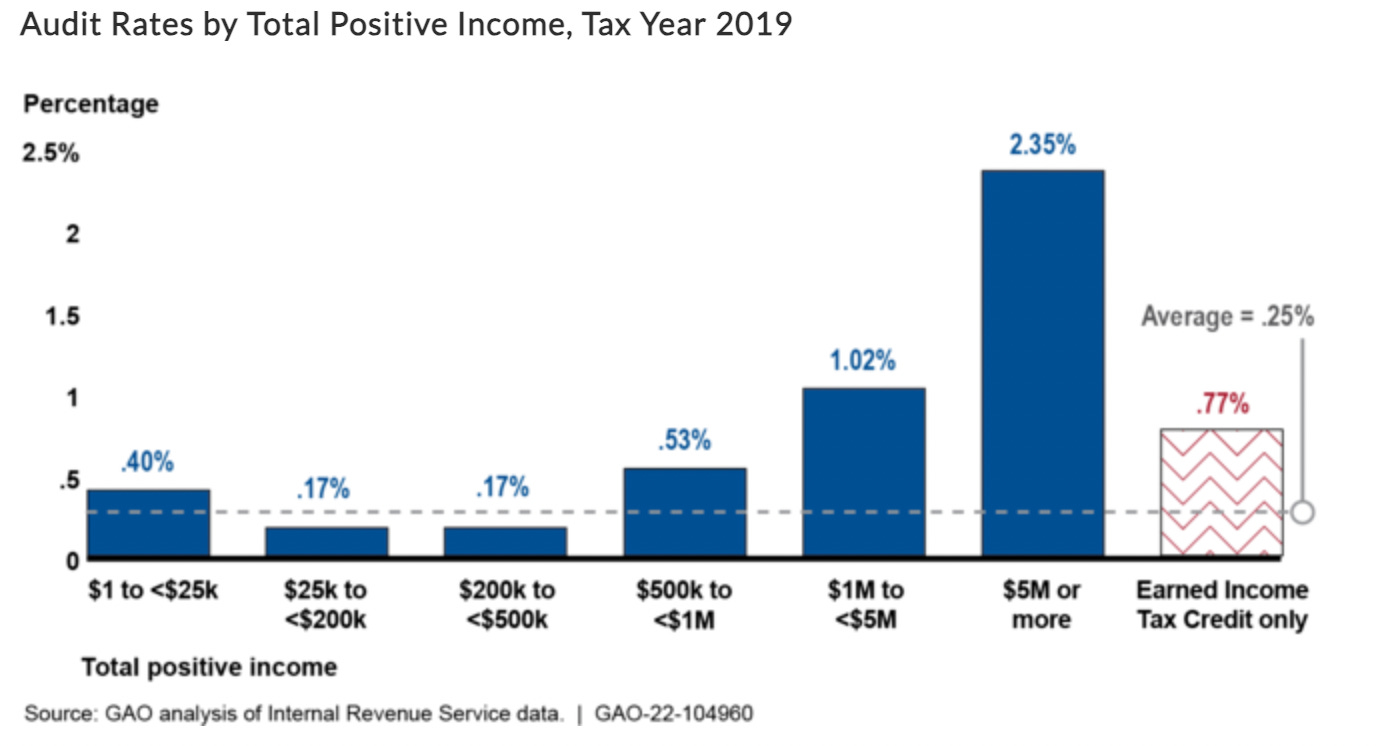

While IRS enforcement capacity declined, the agency cut back their auditing of wealthy individuals’ taxes. These audits take much more work; the wealthy have shell companies, expensive tax lawyers, and all kinds of tools at their disposal to elude enforcement. Thus, the audit rate on millionaires fell to 1%, hitting record lows in 2020. This audit rate is still significantly above the rate faced by middle-class Americans, which is around 1 in every 500 taxpayers.

Source: GAO

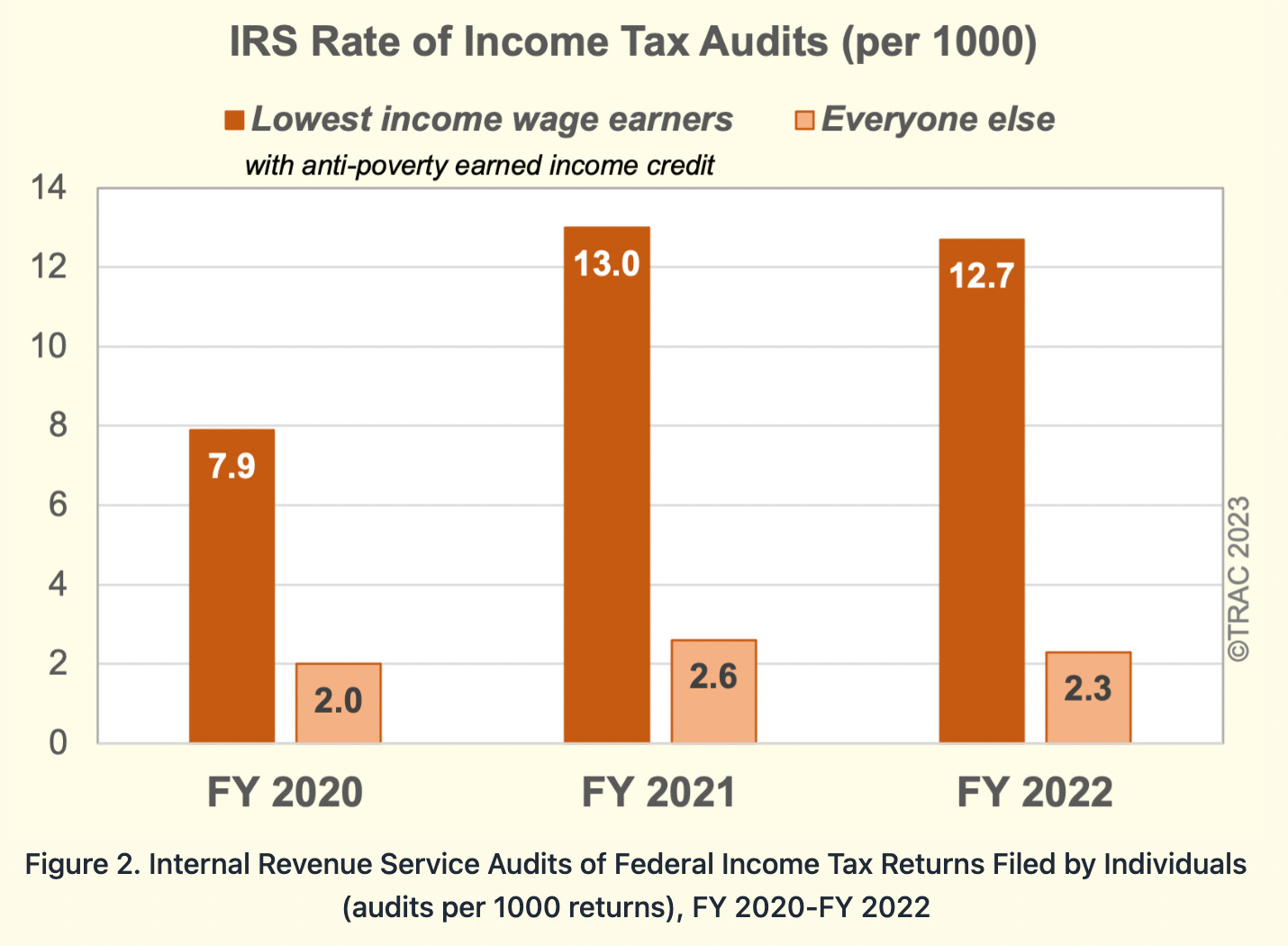

Since President Biden took office, the number of millionaires subjected to IRS audits has increased significantly, though it is nowhere near its pre-Trump level.

Source: TRAC

When the IRA was passed, Treasury Secretary Janet Yellen explained that these new funds for the IRS would be used to increase enforcement on wealthy individuals and help restore equity to the auditing process. She explained that the new IRS resources:

“shall not be used to increase the share of small business or households below the $400,000 threshold that are audited relative to historical levels.”

The truth of Yellen’s statement will only be determinable after tax season, but all signs point in the right direction. The IRS has announced that it’s deploying more agents and new technologies (including artificial intelligence) to target hedge funds, private equity firms, and other complex partnerships.

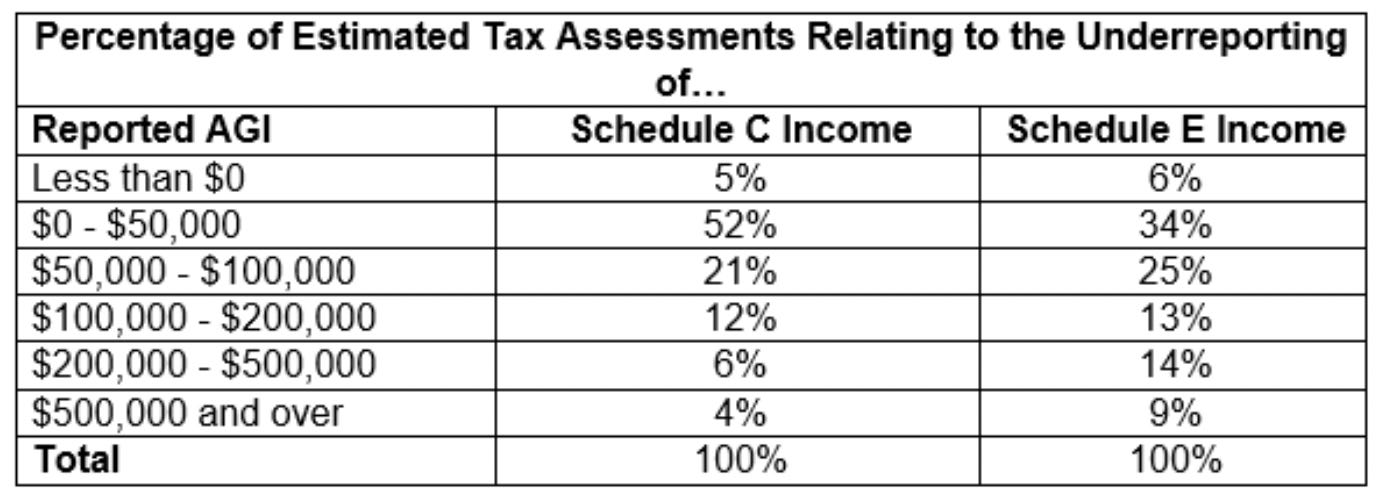

Critics have rightly argued that even if the audit rate stays constant for the middle class, the raw number of audits they face will increase. The Joint Committee on Taxation has found that 78 to 90 percent of new tax revenue will come from increased audits and more targeted enforcement on taxpayers earning less than $200,000 annually.

Source: JCT

If you’re one of the vast majority of Americans who pays their taxes, you have nothing to worry about. And if you happen to make a mistake when filing, for the first time this year the IRS will help you correct those mistakes and get every dollar in credits in refunds you deserve. Per the IRS website:

“For the first time, the IRS will also help taxpayers identify potential mistakes before filing, quickly fix errors that delay their refunds, and more easily claim the credits and deductions they are eligible for. For example, IRS will prompt taxpayers to correct simple math errors before filing and send emails explaining credits and deductions.”

For low-income taxpayers, there is even more good news. In its commitment to equity (and with more resources), the IRS plans to reduce scrutiny on low-income earners and recipients of the Earned Income Tax Credit, which has resulted in heightened and unwarranted scrutiny of poor and Black taxpayers.

Source: TRAC

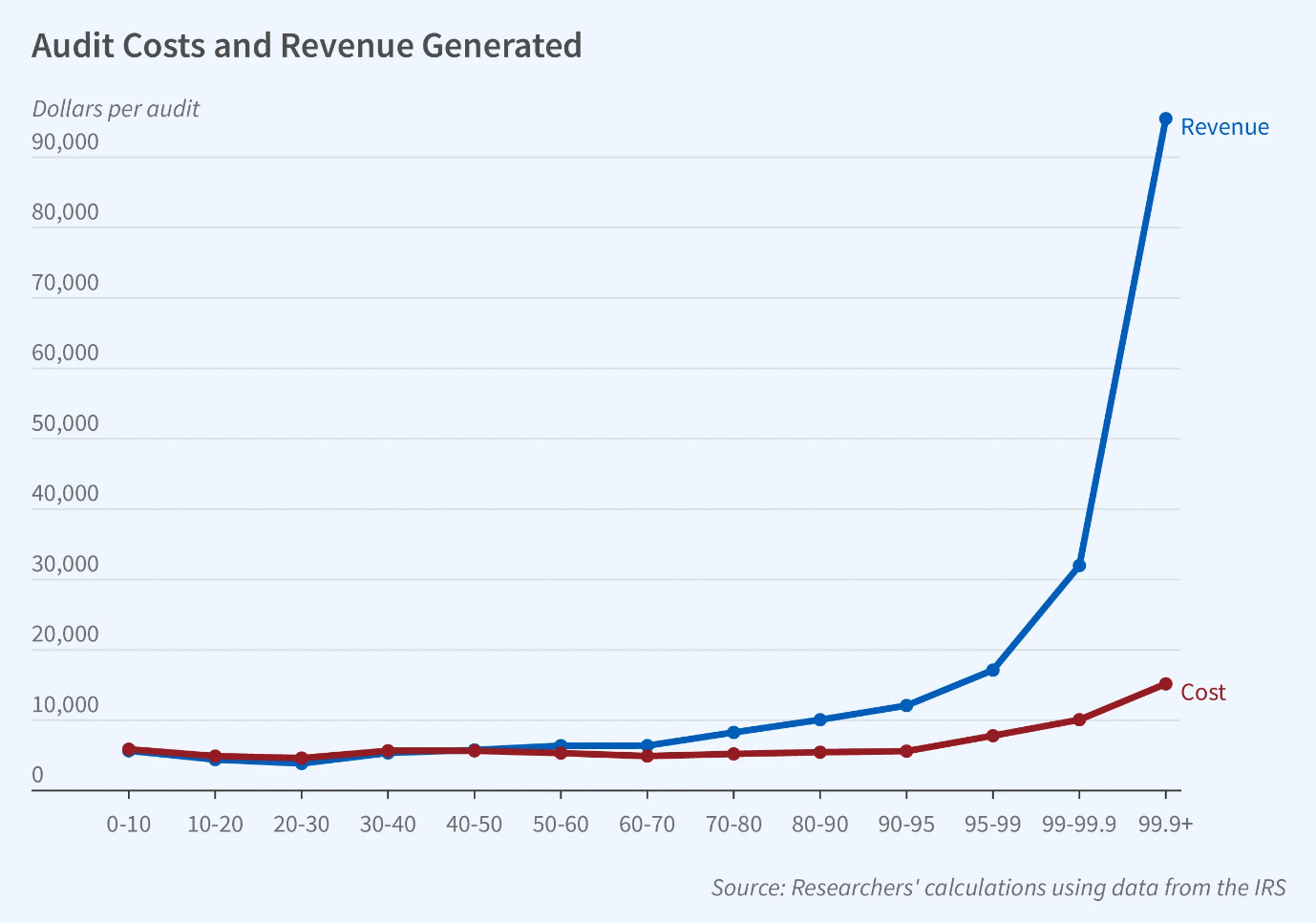

The Congressional Budget Office estimates that this heightened enforcement will bring in an additional $180 billion over the next ten years. The CBO’s estimates also find that without increased enforcement on those earning less than $400,000, the increased revenue would still be in the field of $176 billion, putting itself at odds with the JCT estimate. Regardless, the rate of return on enforcement spending is great, particularly for auditing wealthy taxpayers. For each dollar spent auditing the wealthiest Americans, the government yields between 5 to 9 dollars in additional tax revenue.

Source: NBER

While several politicians have used this beefing up of enforcement to fearmonger about armed IRS agents showing up at your door —in fact, even unarmed IRS agents won’t be showing up now— the reality is much more benign. In the coming years, the IRS is planning to use its new resources to conduct a historic crackdown on wealthy tax cheats. The politicians trying to scare you are concerned about those cheats, not you.

This is absolutely amazing to see. I can’t believe the IRS was so underfunded. Great to see things change. And great research as always.

Glad they are restoring IRS enforcement and getting increased much-needed revenue. I’m sure it will pay off.